PM Insurance & Pension Schemes

A Ready Referencer

A Ready Referencer

Death is the one term which makes everyone scary and the

same fear plays the vital role in availing the insurance on our lives. Death is

certain to happen, how many of us think about what happens to our family after

our death? The insurance provides the solution for this question. It is obvious

that the human life can’t be replaced with the monetary returns, but still,

running a family after losing someone in our family is not an easy thing. These

monetary returns in the form of Insurance claims will be handy at those times.

The below quote holds good to explain about insurance in a nut-shell:

“It's not for you - it's for those you care most about!”

I am sure almost all of you are aware about the recently

launched Prime Minster’s Insurance & Pension schemes. I am just trying to explain the procedures to

apply for these insurance & pension schemes in a nut-shell. I will be

posting about three different schemes launched by the Government:

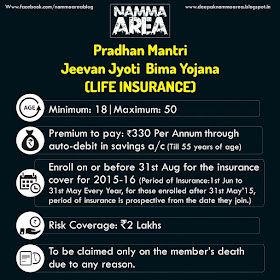

1. Pradhan Mantri

Jeevan Jyoti Bima Yojana (LIFE INSURANCE)

2. Pradan Mantri

Suraksha Bima Yojana (ACCIDENT INSURANCE) &

3. Atal Pension Yojana (PENSION SCHEME)

I have tried to explain the details of these schemes in the

form of Infographic, so that it will be easier for the people to understand.

1. Pradhan Mantri

Jeevan Jyoti Bima Yojana (LIFE INSURANCE)

The basic information is presented in the form of

Infographic below.

How to Apply?

Applying to this scheme is just a simple task. No need for

ID proof, Address Proof, DOB Proof documents. Some banks offer online

application, whereas others offers

offline application.

Off-Line Application

(By Submitting Application form in Bank)

1. Download the form

from the below link: http://www.jansuraksha.gov.in/Files/PMJJBY/English/ApplicationForm.pdf#zoom=250

2. Fill in the form with the necessary details. Since we

already have the account with our banker, this form has very minimal entries to

be filled in. It wont take more than 15 minutes to fill this form.

3. Don’t forget to fill the Aadhar Number if you have one.

4. No need to have / affix Photograph in the application

form.

5. Submit the duly filled in application form to your

banker. They will take care of the rest. Within a week’s time the scheme will

be activated.

On-Line Application:

As far I know, only 4

banks are offering the Online Application for this scheme and links are given

below:

1. ICICI Bank:

Service Requests > Bank Accounts > Enroll for Pradhan

Mantri Jeevan Jyoti Bima Yojana

SMS PMJJY <Nominee name> Y to 5676766 from your

registered mobile number.

2. HDFC Bank:

NetBanking > Click on the ‘Insurance’ tab > Select

Scheme > Select the SB A/C

3. Kotak Mahindra

Bank:

Link: https://www.kotak.com/j1001mp/netapp/MainPage.jsp

SMS JYOTI <nominee name> to 5676788

4. SBI:

Login to NetBanking > My Accounts > Social Security

Schemes > Select the Scheme & Acc no

How and When to

Claim?

The claim can be made only if the member / subscriber died

before 55 years of age after paying the required premiums. The claim should be

initiated by the nominee whose name is mentioned in the application form. The procedure is explained in the form of Infographic

below:

Claim form can be downloaded from the below link:

http://www.jansuraksha.gov.in/Files/PMJJBY/English/ClaimForm.pdf

Key Points to note:

1. This is a one year cover renewable from year to year

2. Cover for the members enrolled after 31st May

2015 will be the prospective period from the date when they enroll to 31st

May 2016. But full premium to be paid.

3. The cover is for the period is till the insured attains

55 years of age. No maturity benefit -

if the contingency (Death) happens before 55 years of age, the claim

will be settled, else no return.

4. It should be operated through savings bank a/c only. If

the members have more than one savings a/c, he can choose any one savings a/c

of his choice. One policy for one

member.

2. Pradan Mantri Suraksha Bima Yojana (ACCIDENT

INSURANCE)

The basic information is presented in the form of

Infographic below.

How to Apply?

As similar to Life Insurance scheme (Pradan Mantri Jeevan

Jyoti Bima Yohana), we can apply online or offline.

Off-Line Application

(By Submitting Application form in Bank)

1.. Download the form

from the below link: http://www.jansuraksha.gov.in/Files/PMSBY/English/ApplicationForm.pdf#zoom=250

2. Fill in the form with the necessary details. Since we

already have the account with our banker, this form has very minimal entries to

be filled in. It wont take more than 15 minutes to fill this form.

3. Don’t forget to fill the Aadhar Number if you have one.

4. No need to have / affix Photograph in the application

form.

5. Submit the duly filled in application form to your

banker. They will take care of the rest. Within a week’s time the scheme will

be activated.

On-Line Application:

As far I know, only 4

banks are offering the Online Application for this scheme and links are given

below:

1. ICICI Bank:

Service Requests > Bank Accounts > Enroll for Pradhan

Mantri Suraksha Bima Yojana

SMS PMSBY <Nominee name> Y to 5676766 from your

registered mobile number*.

2. HDFC Bank:

NetBanking > Click on the ‘Insurance’ tab > Select

Scheme > Select the SB A/C

3. Kotak Mahindra

Bank:

Link: https://www.kotak.com/j1001mp/netapp/MainPage.jsp

SMS SURAKSHA <nominee name> to 5676788

4. SBI:

Login to NetBanking > My Accounts > Social Security

Schemes > Select the Scheme & Acc no

How and When to

Claim?

The claim can be made only if the member / subscriber died

or disabled due to accident before his / her 70 years of age after paying the

required premiums. Keep the below

mentioned details before hand while applying for the claim:

1. Day, Date & Time of Accident

2. Place and Exact location where the accident took place

3. Nature of Accident

4. Details of Injury / Exact cause of death

5. Name address & contact details of Hospital / the

attending doctor(s)

6. Possible time where the medical officer of the company

can visit injured

7. FIR / Death certificate should be obtained

The procedure is explained in the form of Infographic below:

Claim form can be downloaded from the below link:

http://www.jansuraksha.gov.in/Files/PMSBY/English/ClaimForm.pdf

Key Points to note:

1. This is a one year cover renewable from year to year

2. Cover for the members enrolled after 31st May

2015 will be the prospective period from the date when they enroll to 31st

May 2016. But full premium to be paid.

3. The cover is for the period is till the insured attains

70 years of age. No maturity benefit -

if the contingency (Death / disability due to accident) happens before

70 years of age, the claim will be settled, else no return.

4. It should be operated through savings bank a/c only. If

the members have more than one savings a/c, he can choose any one savings a/c

of his choice. One policy for one

member.

3. Atal Pension

Yojana (PENSION SCHEME)

The basic information is presented in the form of

Infographic below.

Indicative Atal

Pension Yojana Monthly Contribution Chart (Based on Age):

1.

Indicative Contribution Chart for Monthly Pension of `1,000

Age of Entry

|

Indicative Monthly

Contribution (`)

|

Age of Entry

|

Indicative Monthly

Contribution (`)

|

|

18

|

42

|

31

|

126

|

|

19

|

46

|

32

|

138

|

|

20

|

50

|

33

|

151

|

|

21

|

54

|

34

|

165

|

|

22

|

59

|

35

|

181

|

|

23

|

64

|

36

|

198

|

|

24

|

70

|

37

|

218

|

|

25

|

76

|

38

|

240

|

|

26

|

82

|

39

|

264

|

|

27

|

90

|

40

|

291

|

|

28

|

97

|

|||

29

|

106

|

|||

30

|

116

|

2. Indicative Contribution Chart for Monthly Pension of `2,000

Age of Entry

|

Indicative Monthly

Contribution (`)

|

Age of Entry

|

Indicative Monthly

Contribution (`)

|

|

18

|

84

|

31

|

252

|

|

19

|

92

|

32

|

276

|

|

20

|

100

|

33

|

302

|

|

21

|

108

|

34

|

330

|

|

22

|

117

|

35

|

362

|

|

23

|

127

|

36

|

396

|

|

24

|

139

|

37

|

436

|

|

25

|

151

|

38

|

480

|

|

26

|

164

|

39

|

528

|

|

27

|

178

|

40

|

582

|

|

28

|

194

|

|||

29

|

212

|

|||

30

|

231

|

3. Indicative Contribution Chart for Monthly Pension of `3,000

Age of Entry

|

Indicative Monthly

Contribution (`)

|

Age of Entry

|

Indicative Monthly

Contribution (`)

|

|

18

|

126

|

31

|

379

|

|

19

|

138

|

32

|

414

|

|

20

|

150

|

33

|

453

|

|

21

|

162

|

34

|

495

|

|

22

|

177

|

35

|

543

|

|

23

|

192

|

36

|

594

|

|

24

|

208

|

37

|

654

|

|

25

|

226

|

38

|

720

|

|

26

|

246

|

39

|

792

|

|

27

|

268

|

40

|

873

|

|

28

|

292

|

|||

29

|

318

|

|||

30

|

347

|

4. Indicative Contribution Chart for Monthly Pension of `4,000

Age of Entry

|

Indicative Monthly

Contribution (`)

|

Age of Entry

|

Indicative Monthly

Contribution (`)

|

|

18

|

168

|

30

|

462

|

|

19

|

183

|

31

|

504

|

|

20

|

198

|

32

|

551

|

|

21

|

215

|

33

|

602

|

|

22

|

234

|

34

|

659

|

|

23

|

254

|

35

|

722

|

|

24

|

277

|

36

|

792

|

|

25

|

301

|

37

|

870

|

|

26

|

327

|

38

|

957

|

|

27

|

356

|

39

|

1054

|

|

28

|

388

|

40

|

1164

|

|

29

|

423

|

5. Indicative Contribution Chart for Monthly Pension of `5,000

Age of Entry

|

Indicative Monthly

Contribution (`)

|

Age of Entry

|

Indicative Monthly

Contribution (`)

|

|

18

|

210

|

31

|

630

|

|

19

|

228

|

32

|

689

|

|

20

|

248

|

33

|

752

|

|

21

|

269

|

34

|

824

|

|

22

|

292

|

35

|

902

|

|

23

|

318

|

36

|

990

|

|

24

|

346

|

37

|

1087

|

|

25

|

376

|

38

|

1196

|

|

26

|

409

|

39

|

1318

|

|

27

|

446

|

40

|

1454

|

|

28

|

485

|

|||

29

|

529

|

|||

30

|

577

|

How to Apply?

We can apply only through off-line mode. To my knowledge,

Banks are not offering online application for this Pension scheme.

Off-Line Application

(By Submitting Application form in Bank)

1. Download the form

from the below link: http://www.jansuraksha.gov.in/Files/APY/ENGLISH/ApplicationForm.pdf#zoom=250

2. Fill in the form with the necessary details. Since we

already have the account with our banker, this form has very minimal entries to

be filled in. It wont take more than 15 minutes to fill this form.

3. Don’t forget to fill the Aadhar Number if you have one.

4. No need to have / affix Photograph in the application

form.

5. Submit the duly filled in application form to your

banker. They will take care of the rest. Within a week’s time the scheme will

be activated.

Key Points to note:

1.The contribution to be made every month.

2. Contributions should be made till 60 years of age.

3. Upon the completion of 60 years, we will have to submit

the request to the our bank (Where we opted for this scheme) for drawing the

guaranteed monthly pension.

4. One can open only one APY account

5. It should be operated through savings bank a/c only. If

the members have more than one savings a/c, he can choose any one savings a/c

of his choice.

6. In case of the death of the subscriber after 60 years of

age, pension would be available to the spouse and on the death of both of them

(subscriber and spouse), the pension corpus would be returned to his nominee.

Once it is done, we will receive an acknowledgement from the bank for all the 3 schemes like the one below:

For Clarifications and doubts regarding any of the above mentioned 3 schemes, we can contact the toll-free numbers below:

Pan India toll-free no: 1800110001 / 18001801111

Toll-Free number for TamilNadu: 18004254415

Credits: http://www.jansuraksha.gov.in, Advertisements in TOI, RBI website etc.,

Conclusion:

It’s a wonderful initiative and we should make use of these

schemes. For a subsidized premium, they offer reasonable return to land the

future in safe hands. Of the 3 above, I personally feel PENSION YOJANA is the

best one.

Voluntary savings for the future has become a history these days. We

got used to spend a lot more than what we earn. This pension scheme will surely

help those who are working in unorganized sector. They face more risk than

those working in organized sector.

Requesting you all to make use of this opportunity and save for the

future. Small drops maketh an ocean,

similarly, these small contributions will turn out to be a lumpsum money in the

future.

This post is just my observation of the PM Insurance &

Pension schemes based on my understanding of the rules prescribed in the Govt

website. Feel free to mail me at innovativedeepak87@gmail.com, if you feel that

the content is being misinterpreted.

I should thank my friends Suren Kumar, Pavithra & Rajiv

for sharing the information and clarifying my doubts while drafting this blog

post. Thanks so much. Thanks to you all for your patience in reading this post.

Let’s make a better tomorrow.