Link Aadhar Card with PAN Card online

in just 3 steps

There has been a lot of confusions over linking the Aadhar card with PAN card for the past few months. The income tax website provided the error message while we tried to link Aadhar with PAN, as the name as per Aadhar is not matching with hte name as per PAN card.

The income tax department's website to link the Aadhar card has been revamped now and we can now link the Aadhar card with the PAN card in just a few clicks by following the below steps.

Step-1: Click the below link to access the Income Tax department's website to link Aadhar card with the PAN card:

https://incometaxindiaefiling.gov.in/e-Filing/Services/LinkAadhaarHome.html

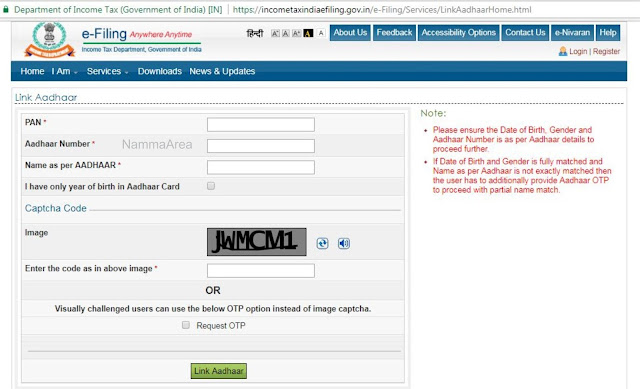

A window will open like the below screenshot:

Step-2: Enter the necessary details as described below:

i) PAN: Enter the 10 digits PAN number in this field

ii) Aadhaar Number: Enter the 12 digits Aadhar Number in this field

iii) Name as per AADHAAR: Enter the the name as in the Aadhaar Card (Make sure to enter the name with the correct spelling as in Aadhaar)

iv) I have only year of birth in Aadhaar card: Check this box only if the aadhar card doesn't have the full date of birth and has only the year of birth. Keep this check box empty if the aadhaar card has full date of birth (Date/Month/Year)

v) Code: Enter the captcha code in the box provided

After filling all the details as above, click on LINK AADHAAR button.

Note: In few instances, OTP may be sent to the registered mobile number when the name as per Aadhaar is not exactly matching with the name as per PAN card.

Additional points to be verified if there is a mismatch between name as per PAN & Aadhaar:

In such case where the name differs between Aadhar & PAN, make sure that the mobile number is registered with aadhar. The last three digits of the registered mobile number (If registered) can be found out in the below link:

https://resident.uidai.gov.in/aadhaarverification

If the mobile number is not registered, it has to be registered first by applying for corrections in Aadhaar card in the nearest Aadhar enrollment center.

Step-3: After submitting the details, a confirmation message will come as a pop-up.

Conclusion: It just takes a maximum of ten minutes time to link Aadhar with PAN through this process. Even if you are not a tax payer and you are holding the Aadhar Card, it is advisable to link the Aadhar with PAN as explained above.

Kindly share the post to make others aware and make sure to educate the people who don't have access to Internet. Be the helping hand by sharing this post especially to those who can't access internet and to the senior citizens.

As a reminder of my previous post in our FB page, Don't share the Aadhar Number to the unsolicited persons over phone or by any other means.

Meet you all in my next post!

Feel free to mail me at innovativedeepak87@gmail.com in case if you need any clarifications / assistance.

Regards,

Deepak Raghuraman

Kindly share the post to make others aware and make sure to educate the people who don't have access to Internet. Be the helping hand by sharing this post especially to those who can't access internet and to the senior citizens.

As a reminder of my previous post in our FB page, Don't share the Aadhar Number to the unsolicited persons over phone or by any other means.

Meet you all in my next post!

Feel free to mail me at innovativedeepak87@gmail.com in case if you need any clarifications / assistance.

Regards,

Deepak Raghuraman